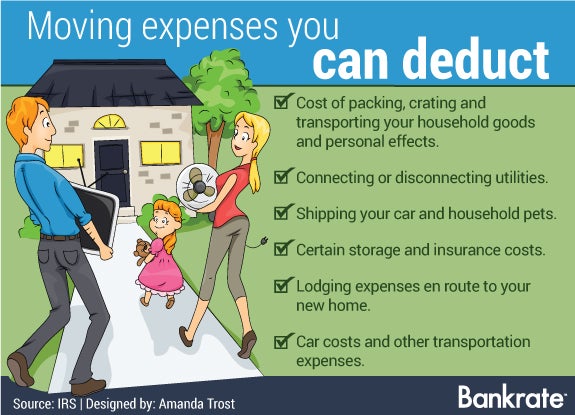

Lease cancellation fees on an apartment used solely for personal purposes are nondeductible personal expenses. The IRS disallowed the lease cancellation fees, and the Tax Court agreed with the IRS. Active-duty military members who move for a permanent change of station are still eligible to claim the following unreimbursed moving expenses on their federal taxes using Form 3903: Travel, by car (either exact costs for gas and oil or the 2021 standard mileage rate of 16 cents per mile), airline or train. He paid lease cancellation fees to get out of his apartment leases in each location and deducted these fees with other moving expenses. Note: A deduction is not allowed for moving expenses for members of the armed forces if your new domicile is outside Wisconsin. In one recent case, a family relocated when a husband’s employer reassigned him from Phoenix, Arizona, to Pasadena, California, in one year, and then from Pasadena to Santa Monica the next year. However, not every move-related expense is deductible. Moving expense reimbursements are a tax-free fringe benefit to employees as long as the expenses are qualified/deductible. For more info on moving expenses and your taxes. Deductions for meals, sightseeing or repairs, maintenance, insurance or deprecation on your vehicle are not allowed. You can either itemize your expenses or choose to deduct 18 centers per mile. You can only claim moving expenses on your taxes if you paid for moving personally. These costs are deductible regardless of whether you itemize your other personal deductions. Costs of car travel you can deduct your expenses for gasoline, oil, lodging parking fees and tolls. Moving expenses are an adjustment to income, not an itemized expense.

#Moving expenses tax deduction full#

Use this step-by-step guide to complete Form 3903: Enter your full legal name and Social Security number. While the bill did help simplify individual taxes and doubled the standard deduction, it also eliminated many deductions including moving expenses. Attach this form to your income tax form when you file your tax return. Enter moving expenses reported on the federal 1040, Schedule 1, line 14 in 2021. Thanks to the Tax Cuts and Jobs Act of 2017, moving expenses are no longer tax deductible. Use IRS Form 3903 Moving Expenses to figure out your moving expenses deduction.

#Moving expenses tax deduction how to#

When you move more than a set distance because of a new job or business, you are entitled to deduct certain moving expenses. How to claim the moving expenses deduction.

0 kommentar(er)

0 kommentar(er)